Miami 시장(Mayor)은 시의 운용자금을 비트코인에 저금, 뉴욕에서도 희망하고 있다고 한다.

나는 비트코인의 Concept을 잘 이해하지는 못하고, 비트코인 하나에 며칠전에 들은 뉴스에 의하면 US 5만 달러가 넘는다고 하는데....참 이해하기가 어렵다.

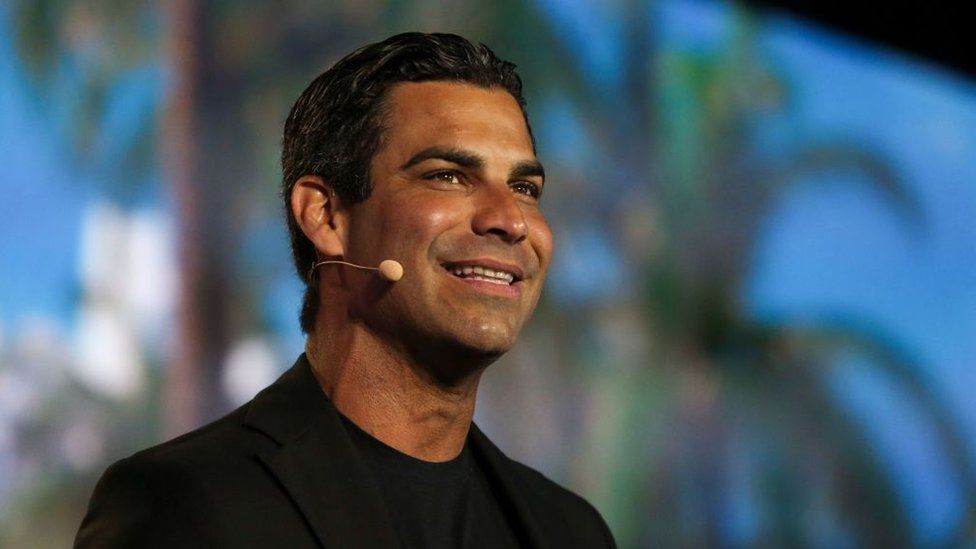

Miami는 또다른 면에서 명성이 높다. 찬란한 태양볕, 아름다운 해변 그리고 큐바커피 등등. 이번에는 마이아미의 시장 Francis Suarez씨가 지금까지 많이 알려진 명성외에 시의 재정을 늘릴수 있는 방법으로 첫번째로 새로운 방법, 즉 비트코인에 투자하겠다는 것이다.

MiamiCoin은, 금년에 시험적으로 시작한 것인데, 이투자로 많은 수입을 얻게되면, 앞으로 '마이아미' 시민들은 시에서 징수하는 세금을 납부할 필요가 없어지게 될것이다'라고 공화당 소속의 시장은 BBC와 인터뷰에서 설명하고 있다.

이러한 목적을 넘어서서, 시장은 희망하기를, 디지탈 이득금을 모든 마이아미 시민들에게 지급할수있는 날이 오기를 바란다고 했다. MiamiCoin은 시장 Suarez씨가 '마이아미'시를 암호화페 거래의 중심지로 성장하도록 이끌어 가기위한 여러 계획중의 하나라고 설명한다.

"나는 우리의 경제의 다양성을 실현하기위한 특별한 기회를 부여 받은것으로 믿고 있으며, pandemic이 발생하기전까지는 ' Miami의 경제규모의 60%이상은 써비스업이었었다. 그러한 경제활동은 Covid에서는 매우 위험한 상태에 처할수있게 노출되여, 나는 이러한 위험함을 바꾸기위한 위험을 다음 후임자에게 넘겨주고 싶지않다" 라고 강조한다.

그러나 Suarez시장이 첫번째로 암호화폐거래를 하는동안에도, 미국에서 암호화폐경제에 뛰어든 단 하나의 시장은 아닌것이다. 다음달에 뉴욕시장으로 임무를 시작하게되는 Eric Adams씨가 또한 매우 열열한 암호화폐에 대한 열성이 대단한 사람이다. 기대가 크다.

"암호화폐(cryptocurrency)"는 어떤 존재인가? 한마디로 설명은 쉽지 않은것 같다.

Suarez씨는 비트코인화폐는 위험성이 많다는것을 알고 있다고 설명하면서, 시행정은 "항상 주의하고 신경써야 하는데 지쳐 버렸다" 라고 설명이다. 시장(mayors)을 알고있는 외부 사람들은 '시장의 혁신적인 준비성을 높이 칭찬하고 있다.

"많은 지방정부들이 여러종류의 재산형성에 여러 종류의 투자를 하고 있다. 어떤이들은 부동산에 수백만 달러를 투자하고, 어떤이들은 본드에 투자한다. 나에게는 이러한것은 또 다른 투자견인차 역활을 할것이며, 솔직히 말해서 지방정부가 할수있는 매우 창조적인 방법이다"라고 Tarkowski씨는 설명한다.

암호화폐를 생각할때는 약간 안개에 쌓인것 같은 생각도 있고, 그러나 범죄가 들끓는다고 생각하는것은 옛날 사고방식이며, 지금은 많은 사람들이 투자하는 새로운 분야다 라고 그녀는 주장한다.

"나는 마이아미 시장, Suarez씨를 굉장히 많이 응원하는데, 왜냐면 그의 현명함과 창조적 생각 그리고 뭔가 새로운것을 향한 노력을 경주하는 점이다"라고 그녀는 설명이다.

지방정부 시장(Mayor)들은 수입원이 되는 새로운 소스에 대해 관심을 갖고 있지않는 "바보"일수도 있지만, 그러한 행동이 시재정에 재정적인 도움을 줄수있다는 점을 잊어서는 안된다.

참고로 중남미의 '애콰돌'에서는 국민들의 공식적인 은행역활을 하고 있는것으로 알고있다.

Miami already has a lot going for it - the sunshine, the beach, the Cuban coffee. Now the city's mayor Francis Suarez wants to put it on the map for another reason: he wants to be the first to create a new way of raising money for the city - through a new cryptocurrency.

MiamiCoin, an experiment he launched this year, could bring in so much revenue that there could be a future scenario where "Miamians would no longer need to pay municipal taxes," the Republican told the BBC.

That is one aspiration, and beyond that, he hopes one day to be able to hand out MiamiCoin to every resident, as a kind of digital dividend.

MiamiCoin is just one part of Mr Suarez's drive to establish Miami as a centre for cryptocurrency.

"I believe we've been presented a very unique opportunity to diversify our economy," he said. "Prior to the pandemic over 60% of Miami's economy was service sector-based. That left us particularly vulnerable to Covid and I won't pass on the chance to change that."

But while Mr Suarez is first out of the blocks, he's not the only mayor in the race for crypto-capital of the US. Hot on his heels is the man about to take over next month as New York mayor, Eric Adams.

What are cryptocurrencies?

Cryptocurrencies, depending who you ask, are either about to revolutionise the global economy, circumventing national governments' hold on finance, and putting power in the hands of ordinary citizens, or they are risky and unstable tools, that enable illegal activities, from ransomware to drug dealing.

A cryptocurrency is a digital product, created without the backing of any central bank or payment system, created or "mined" by computers running complex software programmes.

Anyone willing to invest the time and money to set up the necessary computing equipment can mine, or even establish their own cryptocurrency. They can also be bought and sold, like investing in a commodity.

The best known cryptocurrency, Bitcoin, has attracted enormous attention, has been very volatile, and fortunes have been lost and made investing in it. But many other cryptocurrencies have now been established in its wake.

Mr Adams, a Democrat, who takes office in January, has promised to make New York a crypto-hub. He has talked about city employees getting paid in cryptocurrency and wants lessons on cryptocurrency in New York schools.

Once he'd heard that Mr Suarez had asked to get his first paycheque in Bitcoin, the New Yorker requested the same for his own first three months' pay. Mr Adams is backing his city's version of a cryptocurrency, NYCCoin.

While some of the rivalry may simply be about sending out signals, both mayors are serious about establishing their city as a hub for cryptocurrency business.

In June, Mr Suarez hosted a Bitcoin conference in Miami that attracted around 12,000 enthusiasts including bankers, tech executives and crypto-entrepreneurs. The next one is already planned for April 2022.

And embracing the idea of a city-based crypto-token, like MiamiCoin or NYCCoin, is another way to illustrate commitment to the sector.

Anyone can mine MiamiCoin. When doing so, some of the proceeds of the mining go straight to the miner. The rest goes to a nonprofit initative that underpins the city tokens called CityCoins.

CityCoins gives 30% of the MiamiCoin generated to the City of Miami and 70% is distributed around to all the holders of MiamiCoin.

MiamiCoin, which launched in August, has generated over $20m on behalf of the city, with around 3,500 people taking part in the mining process, according to CityCoins.

It's important to note, that MiamiCoin itself is not money, despite the name, caution Dara Tarkowski, a financial lawyer at Actuate Law in Chicago.

"It functions much more like a security that needs to be traded and then cashed out at some point."

"Its inherent value is purely based on supply and demand," said Ms Tarkowski. "The tokens only have value at the time they're cashed out, and just like a stock we never know what that is going to look like".

None of the MiamiCoin already created has been translated into spending money for the city yet, although Mr Suarez says they are the process now of converting some it into dollars.

"We should be expecting $5m sometime in December," he said.

Meanwhile cryptocurrency miners have already generated more than $25m in NYCCoin for New York's digital wallet.

For now, other cities are watching to see how this experiment in digital fund-raising pans out. And opinion is divided.

Besides their volatility, cryptocurrencies come with plenty of other risks. They have long history of association with criminal activity from ransomware to drugs and there have been numerous cryptocurrency scams. Regulators are still trying to catch up with what rules to impose on what is still a nascent investment sector.

John Reed Stark, cybersecurity consultant with long years of experience at America's top financial regulator, the Securities and Exchange Commission (SEC), as well as in academia, thinks the crypto-mayors could be riding for a fall.

"Ultimately whatever they do with crypto is going to crash and burn and is going to be a disaster," he predicted. He views cryptocurrencies as essentially an elaborate Ponzi scheme, "the ultimate hustle", based on its advocates ramping up interest in a succession of new hyped up projects.

"What they'll realise soon is, the emperor has no clothes. A bank regulator or federal regulator will come along and hopefully intervene and say you cannot do this, you are facilitating criminal enterprises, and you are peddling products that have no intrinsic value," he said.

The SEC is looking closely at cryptocurrency activities and there's good reason for that, said Mr Reed. In his view accepting cryptocurrency is "akin to trading in blood diamonds".

Across the political spectrum politicians have called for stricter regulation, from Elizabeth Warren, the Democratic senator to Donald Trump, the Republican former president.

Mr Suarez said he recognised the risks, but said his administration "exhausted all avenues of due diligence".

And other outsiders are praising the mayors' readiness to innovate.

"Lots of municipalities make all sorts of investments, in a variety of different assets. Some of them invest millions of dollars in real estate, others in bonds," said Ms Tarkowski. "To me this is just another interesting investment vehicle and frankly quite creative for a municipality to do".

The view of cryptocurrencies as something shadowy and criminal is outdated now that so many people are investing in the sector, she argued.

City mayors would be "foolish" not to look at any new sources of income, if it could help supplement their funds, Ms Tarkowski said.

"I would applaud Mr Suarez for some ingenuity and creativity and trying something new," she said.

No comments:

Post a Comment